Why is property insurance in Florida sky-high?

📈 Riding the wave of rising living costs, affecting everything from groceries to auto insurance. Ever wondered why property insurance, particularly in Florida, is scaling new heights? Let's dive into the breakdown:

1. Catastrophic Events: Florida is prone to hurricanes and other natural disasters. The aftermath of events like Hurricane Ian increases claims, burdening insurers with higher costs.

2. Litigation: Extensive litigation, legal battles, and an increase in claims have created a challenging legal environment for insurers. This has the potential to drive up costs as insurers navigate legal challenges.

3. Inflation Impact: Inflation isn't just a buzzword; it's a key player in driving insurance premiums up. The escalating costs of repairs and rebuilding post-claims contribute to a nationwide surge in insurance expenses.

4. Condo Insurance Challenges: The 2021 Surfside condo collapse triggers caution among insurance companies, especially regarding condo buildings in Florida. This caution translates to increased premiums for condo associations.

5. Reduced Insurer Competition: Catastrophes and legal hurdles can force insurers out or strain their finances. With fewer players in the market, the reduced competition spells higher premiums for consumers.

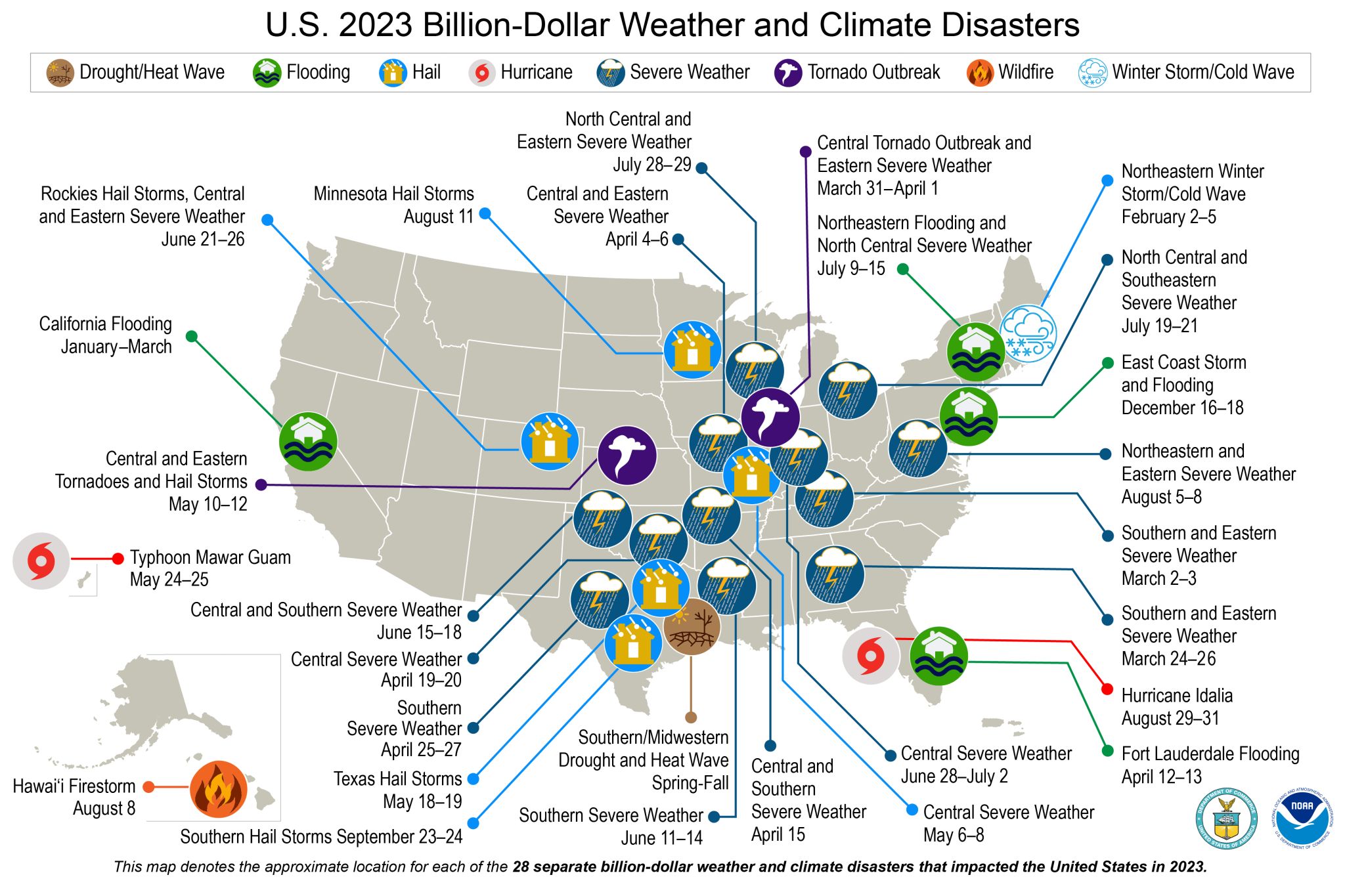

6. Increased Weather/Climate Disasters: NOAA reports 28 weather and climate disaster events in 2023., each causing losses exceeding $1 billion. From droughts to wildfires, these events resulted in lives lost and significant economic impacts.

🌐 National Average Soars: From an annual average of 8.5 events per year (1980–2018) to an alarming surge of 20.4 events per year (2019–2023).

🔄 Impact on Insurance Industry: The perfect storm of natural disasters, legal challenges, inflation, and shifts in the insurance market landscape contributes to the surge in property insurance costs in Florida.

🔍 Unlock Your Ideal Coverage Now! Our relentless pursuit of Excellence persists as we delve into the realm of insurance solutions. Let's secure the most advantageous terms at the best price, tailored to your needs.

Don't miss out—act now! Contact Us

If this is the type of relationship you would like with your insurance professional then we would love to do business with you!

Call or Text 844-2GET-INS (844-243-8467) or Contact Us here.